The A-Z of Back Office Operations for SMBs in UAE and GCC

This guide will walk you through the essential components of back office operations specific to the UAE and GCC markets.

Team Timber

•

Mon 12 May, 2025

Back office operations encompass all the administrative, support, and non-client-facing functions that power a business behind the scenes. For small and medium businesses (SMBs) in the UAE and wider GCC region, these operations form the backbone of organizational efficiency and compliance. While front office activities drive revenue and customer relationships, it's the back office that ensures the business remains compliant, financially sound, and operationally efficient.

SMBs in the UAE and GCC face unique challenges when managing back office operations. The region's complex regulatory environment - characterized by frequent updates to commercial laws, tax regulations, and employment policies—creates a compliance burden that can overwhelm businesses with limited resources. Additionally, the multicultural nature of the workforce, with employees from diverse nationalities and backgrounds, adds complexity to human resource management.

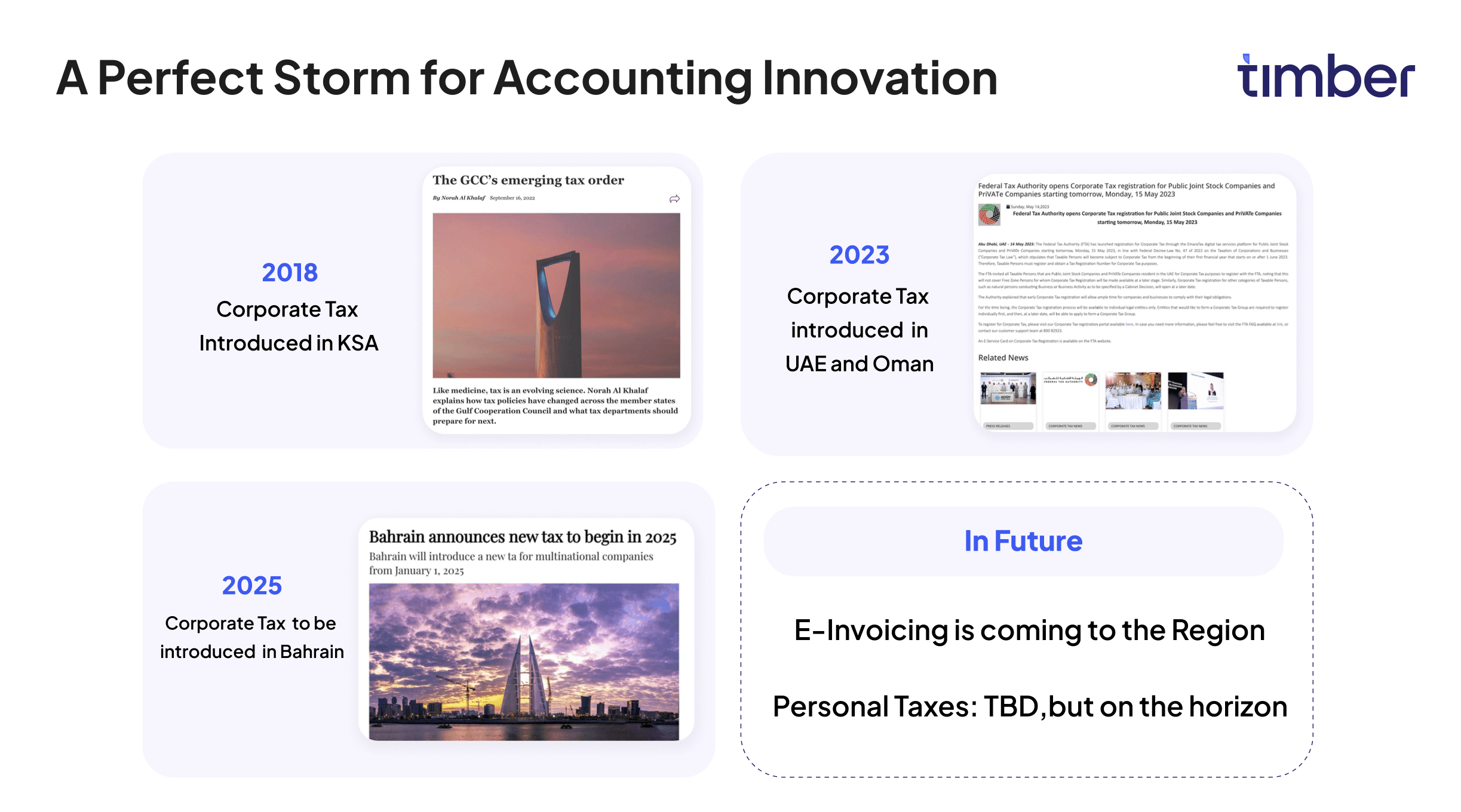

Recent economic diversification efforts across the GCC have introduced new regulations and compliance requirements, further complicating the operational landscape. The introduction of Value Added Tax (VAT), economic substance regulations, Ultimate Beneficial Owner (UBO) documentation, and impending corporate tax in the UAE represent just a few of the recent changes businesses must navigate.

This guide will walk you through the essential components of back office operations specific to the UAE and GCC markets. We'll explore best practices, compliance requirements, technology enablers, and strategic considerations to help SMBs build resilient, efficient, and compliant back office functions that support sustainable growth.

Legal Framework and Compliance

UAE and GCC Business Regulations Overview

The UAE's business regulatory framework operates on multiple levels, creating a complex compliance environment for SMBs to navigate. At the federal level, the UAE Commercial Companies Law (Federal Law No. 2 of 2015, as amended) establishes the foundation for business structures and governance. This law covers company formation requirements, shareholder rights, director responsibilities, and dissolution procedures. Mainland companies must comply with both federal laws and regulations specific to their emirate of registration, typically administered through the Department of Economic Development (DED) or equivalent authority.

Free zones present an alternative regulatory framework. Each of the UAE's 40+ free zones operates under its own regulations, though they must still comply with certain federal laws. Free zones like Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) function as separate legal jurisdictions with their own civil and commercial laws based on English common law principles. Others, like Jebel Ali Free Zone (JAFZA), Dubai Multi Commodities Centre (DMCC), and Dubai Silicon Oasis (DSO), maintain regulations aligned with UAE federal law but offer specific advantages for certain business activities.

The regulatory landscape extends beyond company law to include:

Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT)

regulations requiring businesses in relevant sectors to implement customer due diligence, transaction monitoring, and suspicious activity reporting

Data Protection Laws

that vary by jurisdiction (DIFC Law No. 5 of 2020, ADGM Data Protection Regulations 2021, and Federal Decree Law No. 45 of 2021)

Competition Law

(Federal Law No. 4 of 2012) prohibiting anti-competitive agreements and abuse of dominant market position

Consumer Protection Law

(Federal Law No. 15 of 2020) establishing business obligations toward consumers

Intellectual Property Laws

covering trademarks, patents, and copyrights

Across the wider GCC, regulatory frameworks share similarities but contain important distinctions:

Saudi Arabia has undertaken significant regulatory reform through Vision 2030 initiatives. The new Companies Law of 2015 (amended in 2018) modernized corporate structures, introduced new company types, and simplified formation requirements. The Saudi Arabian General Investment Authority (SAGIA) oversees foreign investment regulations, which have been progressively liberalized to allow 100% foreign ownership in many sectors.

Qatar operates under Law No. 11 of 2015 (Commercial Companies Law), recently amended to allow 100% foreign ownership in most sectors. The Qatar Financial Centre (QFC) provides a separate legal and regulatory framework similar to the DIFC.

Bahrain, Kuwait, and Oman each maintain their own commercial laws with varying degrees of openness to foreign investment, though all have moved toward greater liberalization in recent years.

For SMBs operating across multiple GCC jurisdictions, navigating these different regulatory environments requires sophisticated compliance management systems and often specialized legal support. Practical compliance measures include:

Maintaining a regulatory calendar with key renewal dates and filing deadlines

Implementing a document management system for licenses, certificates, and official correspondence

Establishing relationships with legal advisors familiar with specific jurisdictions

Conducting regular compliance audits

Training key personnel on compliance requirements

Recent Regulatory Changes Affecting SMBs

The past five years have witnessed unprecedented regulatory change across the GCC, fundamentally altering the compliance landscape for SMBs. Understanding these developments is essential for effective back office operations.

Economic Substance Regulations (ESR) were introduced in the UAE in 2019 through Cabinet Resolution No. 31 of 2019 (amended by Cabinet Resolution No. 57 of 2020). These regulations require UAE entities conducting "Relevant Activities" to demonstrate adequate economic presence in the country. The regulations apply to both mainland and free zone companies, including those in financial free zones like DIFC and ADGM.

Relevant Activities include:

Banking

Insurance

Investment Fund Management

Lease-Finance

Headquarters

Shipping

Holding Company

Intellectual Property

Distribution and Service Center

Companies conducting these activities must:

Perform "Core Income Generating Activities" (CIGA) in the UAE

Be directed and managed from the UAE (documented board meetings with quorum physically present)

Maintain adequate employees, premises, and expenditure in the UAE

Submit annual ESR notifications and, if applicable, detailed substance reports

Maintain supporting documentation

Penalties for non-compliance range from AED 20,000 to AED 400,000, with potential suspension, revocation, or non-renewal of trade licenses for repeated violations.

Ultimate Beneficial Owner (UBO) Regulations were implemented through Cabinet Resolution No. 58 of 2020, requiring all UAE entities (excluding those in DIFC and ADGM, which have their own UBO regulations) to identify and report their beneficial owners to the relevant licensing authorities. A beneficial owner is typically defined as an individual who:

Owns or controls 25% or more of the company

Has the ability to appoint or remove the majority of directors

Otherwise exercises significant control over the company or its management

Companies must:

Maintain a register of beneficial owners

Submit UBO information to their licensing authority

Update information within 15 days of any change

Appoint a compliance officer responsible for UBO compliance

Non-compliance can result in fines ranging from AED 100,000 to AED 500,000.

Corporate Tax Introduction represents the most significant recent change to the UAE's financial regulatory landscape. Announced in January 2022 and effective for financial years starting on or after June 1, 2023, the corporate tax regime introduces a 9% tax on business profits above AED 375,000. The framework includes:

0% rate for taxable income up to AED 375,000

9% rate for taxable income above AED 375,000

Different rates for large multinationals and extractive businesses

Exemptions for certain sectors and activities

This fundamental shift requires SMBs to:

Review and potentially restructure operations for tax efficiency

Implement or enhance accounting systems for tax reporting

Develop transfer pricing documentation for related party transactions

Establish tax governance frameworks and controls

Consider implications for shareholder distributions and reinvestment strategies

VAT Updates continue to refine the system introduced in 2018. Recent developments include:

Clarifications on zero-rating and exemptions for specific sectors

Introduction of the "Voluntary Disclosure" system for self-correcting errors

Enhanced rules for input tax recovery

Expanded documentation requirements

Movement toward e-invoicing (expected rollout in coming years)

Labor Law Reforms through Federal Decree-Law No. 33 of 2021 (effective February 2022) overhauled the UAE's employment framework with significant operational implications:

Replacement of unlimited contracts with limited-term contracts (maximum 3 years, renewable)

New work models including part-time, temporary, and flexible arrangements

Enhanced anti-discrimination provisions

Modified end-of-service calculation methods

Revised leave entitlements including study leave and compassionate leave

New termination procedures with minimum notice periods based on service length

For back office operations, these regulatory changes necessitate:

Regular compliance reviews and gap assessments

Enhanced documentation management systems

Updated policies and procedures

Staff training on new requirements

Potential technology investments to support compliance reporting

Financial Management and Accounting

Accounting Standards and Practices

The accounting landscape in the UAE and GCC has evolved toward international standardization, though with important regional variations. The predominant framework is International Financial Reporting Standards (IFRS), though its application varies by jurisdiction and entity type.

In the UAE, publicly listed companies must follow full IFRS as issued by the International Accounting Standards Board (IASB). DIFC and ADGM companies are similarly required to prepare financial statements in accordance with IFRS. For other entities, including most SMBs, IFRS adoption is increasingly common but not universally mandated at the federal level. Some companies, particularly smaller entities, may use IFRS for SMEs, which provides simplified reporting requirements while maintaining consistent accounting principles.

For effective financial management, SMBs should establish a comprehensive accounting framework including:

Chart of Accounts Structure: A well-designed chart of accounts should support both operational management and statutory reporting requirements. For UAE businesses, the structure should accommodate:

VAT tracking (separate accounts for standard-rated, zero-rated, and exempt supplies)

Multi-currency transactions with unrealized and realized exchange differences

Department or cost center tracking for management analysis

Project accounting for service businesses

Inventory categorization for trading companies

Fixed asset classifications aligned with tax depreciation categories

Accounting Policies: Formal, documented accounting policies ensure consistency and compliance. Critical policies for UAE/GCC operations include:

Revenue recognition criteria, particularly for long-term contracts

Inventory valuation methods (FIFO, weighted average, etc.)

Fixed asset capitalization thresholds and depreciation methods

Provisions and accruals methodology

Related party transaction identification and documentation

Foreign currency translation approaches

Leases classification and accounting

Month-End Close Process: A structured monthly close enhances financial control and timely reporting. Effective close processes include:

Standardized close calendar with task assignments and deadlines

Revenue and expense accruals

Reconciliation of all balance sheet accounts to supporting documentation

Inventory count procedures (periodic or perpetual)

Fixed asset register updates

Intercompany transaction reconciliations

Management report generation and review

Variance analysis against budget and prior periods

Internal Controls: Financial management requires robust controls to ensure accuracy and prevent fraud:

Segregation of duties, particularly for payment processing and reconciliations

Approval hierarchies with documented authority limits

Regular review of journal entries and supporting documentation

Bank reconciliation by personnel independent from payment processing

Regular reviews of user access rights to financial systems

Surprise cash counts and inventory checks

Vendor master data management with verification procedures

Tax Compliance

The tax environment in the UAE and GCC has transformed dramatically in recent years, creating significant compliance requirements for back office operations.

VAT Compliance is mandatory for businesses exceeding the registration threshold. Detailed requirements include:

Registration Requirements:

Mandatory registration for businesses with taxable supplies exceeding AED 375,000 annually

Voluntary registration option for businesses with supplies exceeding AED 187,500

Group registration possibilities for related entities

Non-resident registration requirements for certain cross-border services

Invoicing Requirements:

Tax invoices must include specific elements:

Supplier name, address, and Tax Registration Number (TRN)

Customer name, address, and TRN (if registered)

Sequential invoice number

Issue date

Supply date or due date for continuous supplies

Description of goods or services

Quantity and unit price

Taxable amount per rate

Tax rate and amount

Total amount payable

Simplified tax invoices permitted for retail transactions under AED 10,000

Arabic language requirements for certain government entities

Filing and Payment:

Quarterly filing for most businesses (monthly for larger entities)

Filing deadline of 28th day following the end of the tax period

Payment due same day as filing

Online submission through Federal Tax Authority (FTA) portal

Detailed tax return with input and output tax breakdown

Supporting schedules for certain transaction types

Record Keeping:

Five-year retention period (extended to 15 years for real estate)

Records must be maintained in original form (physical or electronic)

Arabic translations required if requested by FTA

Records must be kept within the UAE (with some exceptions for cloud storage)

Common Compliance Challenges:

Proper tax treatment of cross-border transactions

Reverse charge mechanism application

Partial input tax recovery calculations

Documentation requirements for zero-rated and exempt supplies

Treatment of deemed supplies and gifts

Bad debt relief procedures

Corporate Tax Preparation has become an urgent priority for UAE businesses. Key implementation considerations include:

System Readiness:

Accounting software configuration for tax calculations

Chart of accounts alignment with tax reporting categories

Fixed asset register setup for tax depreciation

Transfer pricing documentation capabilities

Tax provision calculation methodologies

Structural Considerations:

Legal entity structure review and potential reorganization

Review of intercompany transactions and pricing

Assessment of permanent establishment risks

Evaluation of available exemptions and incentives

Consideration of free zone tax benefits

Compliance Framework:

Tax governance policy development

Tax risk assessment procedures

Documentation requirements definition

Compliance calendar establishment

Resources allocation (internal vs. external expertise)

Financial Reporting Requirements

UAE and GCC businesses must prepare various financial reports to meet statutory requirements and support management decision-making.

Statutory Financial Statements typically include:

Balance Sheet (Statement of Financial Position):

Assets categorized as current and non-current

Liabilities categorized as current and non-current

Equity components including share capital, reserves, and retained earnings

Comparative figures for the previous year

Income Statement (Statement of Profit or Loss and Other Comprehensive Income):

Revenue breakdown by major category

Cost of sales with appropriate classification

Operating expenses by nature or function

Finance costs separately disclosed

Tax expenses where applicable

Comprehensive income components

Cash Flow Statement:

Operating activities section (typically using indirect method)

Investing activities section

Financing activities section

Reconciliation to cash and cash equivalents

Statement of Changes in Equity:

Movement in share capital

Movement in reserves

Dividend distributions

Total comprehensive income allocation

Notes to the Financial Statements:

Accounting policies summary

Critical accounting judgments and estimates

Detailed breakdowns of major balance sheet items

Related party disclosures

Financial risk management information

Subsequent events disclosure

Going concern assessment

The level of detail required varies by jurisdiction and entity type. DIFC and ADGM entities typically face the most stringent requirements, followed by public joint-stock companies, with private companies having somewhat more flexibility.

Management Reporting supplements statutory reporting with actionable business insights:

Monthly Financial Packages:

Condensed income statement with KPIs

Working capital analysis

Cash flow statement and projections

Segmental analysis by product line, service type, or geography

Headcount and personnel cost analysis

Capital expenditure tracking

Variance Analysis:

Actual vs. budget comparisons

Current period vs. prior period trends

Detailed variance explanations for significant deviations

Corrective action plans for negative variances

Performance Dashboards:

Visual representation of key metrics

Trend analysis with graphical elements

Red/amber/green indicators for KPI status

Drill-down capabilities for deeper analysis

Banking Relationships and Cash Management

Effective banking operations are critical for UAE/GCC businesses given the region's heavy reliance on banking infrastructure for payments and financing.

Banking Setup Considerations:

Account Structure:

Operating accounts in local currency (AED, SAR, QAR, etc.)

Foreign currency accounts for international transactions

Collection accounts for specific revenue streams

Dividend/distribution accounts where relevant

Escrow accounts for regulated activities or specific projects

Electronic Banking:

Dual-control authentication systems

Defined user roles and permissions

Payment approval workflows

Secure access protocols

Mobile banking capabilities

Integration with accounting systems

Trade Finance Facilities:

Letter of credit facilities for imports

Bank guarantee capabilities for tenders and projects

Documentary collection services

Shipping guarantee facilities

Invoice discounting or factoring options

Cash Management Strategies:

Daily Cash Operations:

Beginning-of-day position review

Payment prioritization framework

Intraday liquidity monitoring

End-of-day position reconciliation

Idle fund investment for overnight or short-term periods

Liquidity Optimization:

Cash flow forecasting (13-week rolling basis)

Working capital ratio monitoring

Supplier payment term negotiation

Customer collection strategy implementation

Inventory level optimization

Foreign Exchange Management:

Exposure identification and measurement

Hedging strategy development

Forward contract utilization

Natural hedging through matching currency flows

Regular mark-to-market evaluation

Budgeting and Forecasting

Structured financial planning is essential for navigating the dynamic GCC business environment.

Budget Development Process:

Pre-Budget Preparation:

Macroeconomic research and market analysis

Strategic objective setting and prioritization

Prior year performance review

Key assumption documentation

Budget calendar establishment

Bottom-Up Budgeting:

Departmental template development

Revenue forecasting by product/service line

Headcount planning and personnel cost budgeting

Operating expense detailing by category

Capital expenditure planning with ROI analysis

Budget Consolidation and Review:

Cross-departmental dependency alignment

Consolidated financial statement projection

KPI calculation and evaluation

Multiple scenario testing

Executive review and adjustment

Board approval process

Budget Implementation:

Departmental budget communication

Performance tracking mechanism establishment

Variance reporting framework development

Monthly review cadence implementation

Forecasting Methodologies:

Short-Term Forecasting:

13-week cash flow projections updated weekly

Monthly sales forecasts with pipeline analysis

Inventory requirement projections

Working capital modeling

Medium-Term Reforecasting:

Quarterly budget reforecasting

Year-end projection updates

Scenario analysis based on market developments

Opportunity and risk quantification

Long-Term Financial Planning:

Three to five-year strategic financial plans

Capital structure optimization

Financing requirement identification

Growth initiative financial modeling

Exit or expansion scenario planning

Human Resources Management

Employment Laws in UAE/GCC

The UAE's labor framework is governed primarily by Federal Decree-Law No. 33 of 2021 (effective February 2022), which represents a significant modernization of previous legislation. This law, along with its implementing regulations, establishes comprehensive rules governing employment relationships.

Contract Requirements:

Contract Types:

Limited-term contracts (maximum 3 years, renewable)

No unlimited contracts under new law (existing ones converted)

Part-time contracts (working hours reduced by at least 20%)

Flexible work contracts (varying schedules based on business needs)

Temporary contracts (specific project or time period)

Remote work arrangements

Mandatory Contract Elements:

Employer and employee details

Job title, duties, and work location

Commencement date and duration

Remuneration details including allowances

Working hours and days

Leave entitlements

Notice period and termination conditions

Probation period (maximum 6 months)

Working Conditions Regulations:

Working Hours:

8 hours per day or 48 hours per week standard

Reduction to 6 hours daily during Ramadan for fasting employees

Minimum one-hour daily rest break (not counted in working hours)

Minimum one day off per week

Maximum 2 hours overtime per day with compensation at 125% of normal wage (150% for night work)

Leave Entitlements:

Annual leave: 30 calendar days after one year of service (pro-rated for partial years)

Sick leave: 90 calendar days per year (full pay for first 15 days, half pay for next 30 days, unpaid for remainder)

Maternity leave: 60 calendar days (45 fully paid, 15 at half pay)

Paternity leave: 5 working days

Study leave: 10 working days per year for UAE national employees

Compassionate leave: 5 days for spouse's death, 3 days for parent, child, sibling death

Hajj leave: 30 calendar days once during employment (for Muslim employees)

Termination Provisions:

Notice Requirements:

Minimum 30 days up to maximum 90 days as specified in contract

Payment in lieu of notice option

Employee relieved for reasonable job search time during notice period

Termination Reasons:

Agreement between parties

Contract expiration (if not renewed)

Employer or employee unilateral termination with notice

Termination for cause (specific violations listed in law)

End of Service Benefits:

21 days basic salary per year for first 5 years of service

30 days basic salary per year beyond 5 years

Maximum cap of 2 years' total salary

Calculated on basic salary (excluding allowances)

Pro-rated for partial years

Potential reductions for resignation (dependent on service length)

Other GCC countries have similar but distinct labor regulations:

Saudi Arabia operates under Labor Law Royal Decree No. M/51, with recent reforms expanding employee rights, enhancing job mobility through the removal of previous employer consent for transfers, and introducing more flexible work arrangements.

Qatar's Law No. 14 of 2004 (as amended) has undergone significant modernization, including the landmark removal of the exit permit requirement for expatriate workers and elimination of the No Objection Certificate (NOC) system that previously restricted job changes.

Bahrain, Kuwait, and Oman each maintain their own labor laws with varying provisions regarding nationalization quotas, termination conditions, and working hours, though all have moved toward greater worker protections in recent years.

Visa and Work Permit Processes

Managing employment visas represents one of the most complex back office functions for UAE businesses, requiring meticulous process management and documentation.

Employment Visa Process Flow:

Initial Approval Phase:

Preparation of labor contract meeting Ministry of Human Resources and Emiratization (MOHRE) standards

Job offer letter issuance

Educational certificate attestation (varies by nationality and profession)

Initial approval application submission to MOHRE or free zone authority

Approval receipt and entry permit processing

Entry and Status Change:

Entry permit issuance (valid for 60 days)

Employee entry to UAE

Emirates ID registration and biometric capture

Medical fitness test at government-approved center

Status change processing (for those entering on visit visas)

Labor contract signing and registration

Residence Visa Issuance:

Work permit/labor card issuance

Passport submission for visa stamping

Emirates ID card collection

Medical insurance policy issuance (mandatory in Dubai, Abu Dhabi, and most free zones)

Dependent visa processing (if applicable)

The entire process typically takes 2-4 weeks depending on the jurisdiction, nationality of the employee, and specific circumstances. Required documentation includes:

Passport valid for at least 6 months

Educational certificates attested by UAE embassy in country of issuance

Passport-sized photographs with white background

Job offer letter

Labor contract

Entry permit copy

Medical fitness certificate

Emirates ID application

Dependent Visa Considerations:

Eligibility Criteria:

Minimum salary requirement (typically AED 4,000-10,000 depending on profession)

Appropriate accommodation (evidenced through tenancy contract)

Relationship proof (attested marriage certificate, birth certificates)

Process Steps:

Entry permit application with sponsor's income documentation

Medical testing for dependents

Emirates ID registration

Insurance policy issuance

Residence visa stamping

Visa Compliance Management:

Renewal Requirements:

Initiation 30-60 days before expiration

Updated documentation including labor contract

New medical testing

Insurance policy renewal

Fee payment

Cancellation Procedures:

Final settlement calculation and payment

Labor contract cancellation through MOHRE or free zone

Visa cancellation application

Passport visa page cancellation

Gratuity payment documentation

Option for visa transfer to new employer (subject to conditions)

Absconding Reporting:

Official notification requirement if employee is absent for 7+ consecutive days without approved leave

Documentation of communication attempts

Filing through official channels (MOHRE or free zone)

Potential liability implications if not properly reported

Emiratization/Nationalization Policies

GCC countries have implemented increasingly stringent nationalization programs to boost employment of citizens in the private sector. In the UAE, Emiratization policies have evolved significantly in recent years.

UAE Emiratization Framework:

Quota Systems:

Banking sector: 4% annual increase with penalties for non-compliance

Insurance sector: 5% of total workforce

Private sector companies with 50+ employees: 2% of skilled positions annually, reaching 10% by 2026

Classification Systems:

Tawteen Partners Club categorizes companies based on Emiratization performance

Classifications range from Platinum (highest) to Fourth Category (lowest)

Benefits for higher categories include:

Reduced service fees

Priority in government dealings

Higher visa quotas

Exclusivity for certain government tenders

Financial Incentives and Penalties:

Nafis program offering salary support for UAE nationals in private sector

Financial contributions required from non-compliant companies (AED 6,000 monthly per unfilled position)

Potential suspension of services for persistent non-compliance

Implementation Best Practices:

Strategic Recruitment:

Partnerships with UAE national universities

Participation in dedicated Emiratization career fairs

Development of UAE national-specific employer branding

Internship and cooperative education programs

Retention Programs:

Customized career development plans

Mentorship and coaching initiatives

Competitive compensation benchmarking

Recognition programs aligned with cultural values

Cultural Integration:

Cross-cultural training for management

Work environment accommodations for cultural and religious practices

Family engagement initiatives

National identity celebration events

Similar nationalization programs exist across the GCC:

Saudi Arabia's Nitaqat program classifies companies into color-coded categories (Platinum, Green, Yellow, Red) based on Saudization percentages, with corresponding benefits or restrictions. Recent initiatives include the Saudi Employment Strategy aiming to reduce unemployment to 7% by 2030.

Qatar's Qatar National Vision 2030 includes Qatarization targets, with regulated sectors like energy having specific quotas (typically 20-50% depending on the subsector).

Bahrain, Kuwait, and Oman maintain similar programs with varying implementation mechanisms and sector-specific targets.

Payroll Management and WPS Compliance

The Wage Protection System (WPS) represents one of the most significant compliance requirements for UAE employers, mandating electronic salary payments through approved channels.

WPS Requirements and Implementation:

Registration Process:

WPS agent selection (typically a bank or exchange house)

Agent agreement completion

Establishment card registration

Employee bank account documentation

Salary information file template preparation

Monthly Payment Process:

Payroll calculation with appropriate deductions and allowances

SIF (Salary Information File) preparation in prescribed format

SIF submission to WPS agent at least one day before payment

Fund transfer to agent (covering total salary amount plus fees)

Electronic distribution to employee accounts

Receipt of payment confirmation

Timing Requirements:

Payment within 15 days of due date as specified in contract

Regular payment schedule (monthly or more frequent)

Clear documentation of payment date in employment contracts

Common Compliance Issues:

Incorrect SIF formatting leading to rejection

Insufficient funds for complete payroll processing

Delayed submissions resulting in late payments

Inconsistencies between labor contract amounts and actual payments

Unauthorized deductions

Cash payments outside the WPS

Penalties for Non-Compliance:

Fines starting at AED 5,000 and increasing with repeated violations

Potential work permit restrictions

Legal cases through MOHRE

Company classification downgrades

Similar electronic wage payment systems exist across the GCC:

Saudi Arabia's

Wage Protection System requires electronic salary payments with monitoring by the Ministry of Human Resources

Qatar's

Wage Protection System mandates electronic payments through approved financial institutions

Bahrain, Kuwait, and Oman

have implemented or are implementing comparable systems

Comprehensive Payroll Process Elements:

Pre-Payroll Activities:

Time and attendance data collection and verification

Leave management integration

Overtime calculation and approval

Allowance and deduction processing

New hire and termination prorations

Loan and advance management

Payroll Processing:

Gross-to-net calculations

Tax considerations for applicable nationalities

Social insurance calculations (for GCC nationals)

End-of-service benefit accruals

Payment file generation

WPS file creation and submission

Post-Payroll Activities:

Payment confirmation and reconciliation

Payslip distribution (electronic or physical)

General ledger posting and reconciliation

Statutory reporting

Management reporting on personnel costs

Record retention (typically 7+ years)

Employee Benefits Administration

Effective benefits administration is crucial for attracting and retaining talent in the competitive UAE/GCC labor market.

Mandatory Benefits Management:

Medical Insurance:

Abu Dhabi: Comprehensive coverage required for all employees and dependents

Dubai: Basic coverage required for all employees (dependent coverage at employer discretion)

Sharjah and Northern Emirates: No mandatory requirement at emirate level

Coverage requirements vary by jurisdiction:

Minimum annual limit (typically AED 150,000-250,000)

Preexisting condition coverage

Maternity benefits

Network adequacy standards

Work Injury Insurance:

Mandatory coverage for workplace accidents and occupational diseases

Benefit calculation based on severity and basic salary

Reporting requirements to MOHRE within specific timeframes

Return-to-work program documentation

End-of-Service Benefits:

Accurate accrual calculations based on current salary levels

Monthly provision entries in accounting system

Funding strategies (internal accruals vs. external plans)

Payment processing upon termination

Tax implications for certain nationalities

Voluntary Benefits Framework:

Supplementary Medical Coverage:

Enhanced limits beyond mandatory minimums

Expanded network options

Additional benefits (dental, vision, wellness programs)

Executive medical plans for senior management

Insurance Programs:

Life insurance (typically 24-48 times monthly salary)

Disability coverage (short-term and long-term)

Personal accident insurance

Critical illness coverage

Housing and Transportation:

Housing allowance or company accommodation

Transportation allowance or company vehicles

Home leave ticket policies

Relocation assistance

Education Support:

Children's education allowances

Employee continuing education reimbursement

Professional certification support

Conference and workshop participation

Wellness Programs:

Fitness membership subsidies

Health screening initiatives

Mental wellbeing support

Work-life balance policies

Administration Mechanisms:

Policy Documentation:

Comprehensive benefits handbook

Clear eligibility criteria

Enrollment procedures and deadlines

Claims submission processes

Dispute resolution mechanisms

Technology Solutions:

Benefits administration modules in HRIS

Online enrollment platforms

Mobile app access for claims and information

Integration with payroll for automatic deductions

Communication Strategies:

Initial benefits orientation during onboarding

Annual enrollment communications

Multi-lingual materials (considering workforce diversity)

Regular benefits utilization reports

Education sessions on optimal benefits usage

Training and Development Systems

Structured employee development is increasingly important for UAE/GCC businesses seeking to build capabilities and retain talent.

Training Infrastructure Components:

Skills Assessment Framework:

Competency mapping by role and level

Technical and soft skills evaluation

Assessment methodologies (360-degree feedback, knowledge tests, performance evaluation)

Gap analysis against required competencies

Individualized development planning

Learning Management System:

Course catalog management

E-learning module delivery

Training registration and approval workflows

Completion tracking and certification

Learning path customization

Content management capabilities

Delivery Methodologies:

Classroom training facilities and infrastructure

Virtual learning platforms

Blended learning approaches

Microlearning modules for just-in-time knowledge

On-the-job coaching structures

External program selection criteria

Mandatory Training Management:

Compliance Training:

Health and safety (appropriate to industry)

Anti-money laundering and financial crimes (for relevant sectors)

Data protection and information security

Anti-harassment and discrimination

Code of conduct and ethics

Certification Tracking:

Professional license monitoring

Industry-specific certification requirements

Renewal notification systems

Documentation management

Regulatory reporting where required

Performance Management Integration:

Goal Setting and KPI Definition:

Alignment with organizational objectives

SMART criteria application

Weighting methodology

Regular progress monitoring

Adjustment procedures for changing priorities

Review Mechanisms:

Structured review cycles (annual, bi-annual, quarterly)

Self-assessment components

Manager evaluation procedures

Calibration processes for consistency

Documentation requirements

Performance improvement plan protocols

Recognition Programs:

Non-monetary recognition frameworks

Monetary reward structures

Peer recognition systems

Performance-based promotion criteria

Service anniversary celebrations

Cultural considerations for recognition approaches

Technology Infrastructure

Essential Technology Systems for SMB Back Offices

The digital backbone of effective back office operations consists of integrated systems that automate processes, enhance control, and provide actionable insights. SMBs in the UAE and GCC should prioritize the following technology components:

Core Financial Systems:

Enterprise Resource Planning (ERP) or Accounting Software:

Multi-entity capability for group structures

Multi-currency functionality with automated exchange rate updates

VAT-compliant tax engine with UAE/GCC-specific reporting

Fixed asset management with appropriate depreciation methods

Inventory management with FIFO/LIFO/weighted average costing

Bank integration for automated reconciliation

Financial statement generation aligned with IFRS requirements

Drill-down capabilities for transaction analysis

Role-based access controls with appropriate segregation of duties

Audit trail functionality for compliance purposes

Selection considerations include:

Scalability to accommodate business growth

Local support availability in the UAE/GCC

Arabic language support where required

Compliance with FTA requirements for VAT

Cloud vs. on-premises deployment options

Implementation timeline and resource requirements

Total cost of ownership (licensing, implementation, maintenance)

Popular solutions in the region include SAP Business One, Microsoft Dynamics 365 Business Central, Oracle NetSuite, Zoho Books, QuickBooks, and Tally, with selection dependent on business size, complexity, and budget.

Banking and Treasury Management:

Electronic banking platforms with payment initiation and approval workflows

Cash forecasting tools with scenario modeling

Bank fee analysis and optimization

Trade finance management functionality

FX exposure monitoring and hedging tools

Liquidity management dashboards

Bank account reconciliation automation

Expense Management:

Mobile receipt capture and submission

Automated expense categorization and policy compliance checking

Approval workflow configuration

Integration with accounting systems for posting

Reimbursement processing automation

Corporate card management

VAT recovery facilitation

Expense analytics and reporting

Human Resources Systems:

Human Resources Information System (HRIS):

Employee master data management

Organization structure and position management

Document management for employee files

Visa and work permit tracking with expiration alerts

Benefits administration and enrollment

Time-off management with balance tracking

Self-service capabilities for employees and managers

Compensation management with salary structure enforcement

Performance management workflow support

Reporting and analytics dashboards

Payroll Processing:

UAE/GCC-specific calculation rules

WPS file generation and submission

End-of-service benefit computation

Multi-currency handling for expatriate packages

Leave accrual and encashment calculations

Allowance and deduction management

Tax handling for applicable nationalities

General ledger integration

Historical data retention

Compliance reporting capabilities

Recruitment and Applicant Tracking:

Job requisition and approval workflows

Career portal integration

Application screening and ranking

Interview scheduling and feedback collection

Assessment administration

Offer management with approval chains

Onboarding process automation

Candidate communication tools

Analytics for recruitment effectiveness

Integration with HRIS for seamless data transfer

Operations Support Systems:

Document Management:

Centralized repository with version control

Role-based access permissions

Retention policy enforcement

Search functionality with metadata filtering

Annotation and collaboration tools

Mobile access capabilities

Audit trail of document activities

Integration with business applications

Electronic signature capability

Compliance with UAE Electronic Transactions Law requirements

Workflow Automation:

Visual process design tools

Form creation and customization

Approval routing with delegation capabilities

Status tracking and reporting

SLA monitoring and escalation

Integration with core business systems

Mobile approval functionality

Audit logs for compliance purposes

Business Intelligence:

Data warehouse or data lake architecture

ETL (Extract, Transform, Load) capabilities

Interactive dashboard creation

Ad-hoc reporting tools

KPI monitoring with alert functionality

Data visualization components

Mobile analytics access

Scheduled report distribution

Data security and governance features

Compliance Management:

Regulatory update tracking

Obligation management and deadline monitoring

Document submission scheduling

Risk assessment tools

Audit preparation support

Training management for compliance topics

Incident reporting and investigation

Remediation tracking

Digital Transformation Roadmap

Implementing technology solutions requires a structured approach to ensure successful adoption and return on investment.

Assessment Phase:

Process Mapping and Optimization:

Current state documentation with process flows

Pain point identification and prioritization

Efficiency opportunity assessment

Compliance gap analysis

Benchmark comparison with industry standards

Process redesign before automation (to avoid digitizing inefficient processes)

Stakeholder input gathering

Future state process mapping

Technology Needs Analysis:

Functional requirements documentation

Technical requirements specification

Integration needs assessment

Scalability considerations

Security and compliance requirements

Mobile accessibility needs

Reporting and analytics requirements

User experience priorities

Current System Evaluation:

Existing technology inventory and assessment

Capability gap identification

Integration limitations

Support and maintenance challenges

License and subscription review

Technical debt quantification

User satisfaction measurement

Total cost of ownership calculation

Implementation Strategy:

Approach Selection:

Big bang vs. phased implementation evaluation

Pilot testing strategy development

Parallel running considerations

Risk mitigation planning

Contingency planning for critical processes

Timeline development with key milestones

Resource allocation planning

Change management strategy

Vendor Selection Process:

Requirements prioritization (must-have vs. nice-to-have)

RFP development and distribution

Vendor response evaluation methodology

Demonstration scripts and scenarios

Reference check protocol

Site visit planning

Scoring system development

Contract negotiation strategy

Service level agreement development

Implementation Planning:

Project team formation with clear roles and responsibilities

Detailed project plan with dependencies

Data migration strategy

Testing methodology (unit, integration, user acceptance)

Training plan development

Go-live readiness assessment criteria

Post-implementation support structure

Success metric definition

Continuous Improvement:

Performance Monitoring:

Key performance indicators alignment with business objectives

System utilization tracking

Process efficiency measurement

User adoption metrics

Return on investment calculation

Exception monitoring and root cause analysis

Support ticket trend analysis

System performance monitoring

User Feedback Collection:

Structured feedback surveys

Focus group sessions

User experience testing

Feature request management

Pain point identification

Success story documentation

User community development

Technology Roadmap Maintenance:

Regular technology assessment against business needs

Update and upgrade planning

New functionality evaluation

Integration opportunity identification

Security and compliance review

Performance optimization planning

User experience enhancement identification

Emerging technology evaluation

Outsourcing vs. In-house Operations

Functions Suitable for Outsourcing

Strategic decision-making around which functions to perform in-house versus outsource requires careful evaluation of various factors. For UAE and GCC businesses, certain back office functions lend themselves particularly well to outsourcing.

Accounting and Financial Functions:

Transactional Accounting:

Accounts payable processing

Accounts receivable management

Bank reconciliation

General ledger maintenance

Fixed asset register management

Month-end close support

Financial statement preparation

Specialized Financial Services:

VAT return preparation and filing

Corporate tax compliance (increasingly important with UAE corporate tax)

Payroll processing and WPS submission

Treasury management

Internal audit execution

External audit preparation support

Financial analysis and reporting

Human Resources Functions:

Administrative HR:

Personnel file maintenance

Leave management administration

Benefits administration

Visa and work permit processing

Employee onboarding and offboarding documentation

HRIS data maintenance

Employee helpdesk services

Specialized HR Services:

Recruitment and candidate screening

Compensation benchmarking

Training delivery

Performance management administration

Employee engagement survey administration

HR compliance monitoring

Business Support Functions:

Administrative Services:

Document management and archiving

Translation services

Reception and front desk operations

Mail and courier management

Office supply management

Facilities management

Travel arrangement services

IT Services:

Helpdesk and technical support

Infrastructure management

Network administration

Cybersecurity monitoring

Backup and recovery management

Application support and maintenance

IT compliance monitoring

Government Relations Functions:

PRO Services:

Company license renewals

Employee visa processing

Document attestation and legalization

Government transaction processing

Translation and typing center coordination

Court representative services

Regulatory filing management

Evaluation Criteria for Outsourcing Decisions:

Strategic Importance Assessment:

Core vs. non-core business activities evaluation

Competitive advantage contribution analysis

Intellectual property considerations

Confidentiality and data sensitivity assessment

Strategic control requirements

Long-term capability development needs

Resource Evaluation:

Internal expertise availability and gaps

Recruitment and retention challenges for required skill sets

Training and development investment requirements

Management bandwidth for function oversight

Physical infrastructure and technology requirements

Scalability needs for business growth

Cost Analysis:

Fully-loaded internal cost calculation (including salaries, benefits, training, facilities, technology)

Outsourcing price models evaluation (fixed fee, transaction-based, time and materials)

Hidden cost identification (transition, management oversight, integration)

Variability of demand assessment

Economies of scale opportunities

Tax and accounting implications

Risk Assessment:

Compliance risk evaluation

Operational risk analysis

Dependency risk assessment

Transition risk identification

Quality control challenges

Business continuity concerns

Reputational considerations

Selecting Service Providers

Choosing the right outsourcing partners is critical for success, particularly in the UAE and GCC where regulatory compliance requirements are significant.

Due Diligence Process:

Technical Capability Assessment:

Service methodology evaluation

Technology infrastructure review

Process documentation quality

Quality control mechanisms

Performance management approach

Continuous improvement philosophy

Problem resolution procedures

Service escalation protocols

Industry Experience Verification:

Client portfolio in similar industries

Understanding of sector-specific regulations

Specialized knowledge demonstration

Case study and success story evaluation

Client reference checks with similar businesses

Industry certification and accreditation

Thought leadership evidence in the sector

Team Qualification Review:

Key personnel experience and qualifications

Team stability and turnover rates

Training and development programs

Staff certification levels

Knowledge transfer mechanisms

Backup staffing arrangements

Cultural fit with your organization

Language capabilities (Arabic, English, others as needed)

Operational Resilience Evaluation:

Business continuity planning

Disaster recovery capabilities

Redundancy in critical systems

Backup procedures and testing

Insurance coverage adequacy

Financial stability assessment

Succession planning for key roles

Geographic distribution of operations

Security and Compliance Verification:

Information security certifications (ISO 27001, etc.)

Data protection policies and procedures

Physical security measures

UAE/GCC regulatory compliance history

Industry-specific compliance capabilities

Privacy controls and GDPR compliance where applicable

Audit rights and transparency

Breach notification procedures

Contractual Considerations:

Service Level Agreements:

Clearly defined service scope with deliverables

Measurable performance metrics

Response and resolution time commitments

Quality standards and acceptance criteria

Reporting frequency and content

Review meeting cadence

Continuous improvement expectations

Performance incentives and penalties

Commercial Terms:

Pricing structure clarity (fixed, variable, hybrid)

Cost escalation mechanisms

Currency and exchange rate provisions

Payment terms and conditions

Expense reimbursement policies

Contract duration and renewal terms

Volume flexibility provisions

Early termination options and costs

Governance Framework:

Roles and responsibilities definition

Decision-making authority matrix

Issue escalation procedures

Change management processes

Performance review mechanisms

Innovation and improvement framework

Communication protocols

Dispute resolution procedures

Risk Management Provisions:

Confidentiality and non-disclosure requirements

Intellectual property ownership

Data security and privacy requirements

Liability limitations and indemnification

Insurance requirements

Force majeure provisions

Regulatory compliance responsibilities

Exit and transition provisions

Managing Outsourced Relationships

Effective governance of outsourcing relationships is essential for realizing the expected benefits while managing risks.

Governance Framework:

Strategic Oversight:

Executive sponsorship assignment

Steering committee establishment with clear charter

Strategic alignment review process

Long-term relationship planning

Value realization assessment

Risk monitoring and mitigation

Innovation and improvement direction

Operational Management:

Day-to-day relationship management roles

Operational meeting cadence (daily, weekly, monthly)

Issue tracking and resolution procedures

Performance dashboard development

Escalation protocols for service issues

Change request management process

Continuous improvement mechanism

Performance Evaluation:

KPI monitoring against targets

Service level agreement compliance tracking

Quality review methodology

User satisfaction measurement

Benchmarking against market standards

Performance review meeting structure

Improvement plan development and tracking

Recognition and reward mechanisms

Integration Strategies:

Process Integration:

End-to-end process mapping with handoff points

Clear responsibility matrix (RACI) development

Standard operating procedure documentation

Joint process improvement initiatives

Exception handling procedures

Escalation protocols for process breakdowns

Process audit methodology

Technology Integration:

System integration requirements definition

Data exchange protocols and standards

Security requirements and controls

Access management and authentication

Change management coordination

Testing and validation procedures

Disaster recovery synchronization

Technology roadmap alignment

People Integration:

Cultural alignment initiatives

Joint training programs

Knowledge sharing mechanisms

Relationship building activities

Communication protocol development

Feedback channels establishment

Career development opportunities

Recognition and appreciation programs

Cost-Benefit Analysis

Comprehensive evaluation of outsourcing decisions requires thorough analysis of both quantitative and qualitative factors.

Quantitative Factors:

Direct Cost Comparison:

Internal labor costs (salaries, benefits, bonuses, training)

Facility costs (office space, utilities, equipment, maintenance)

Technology costs (software licenses, hardware, support, upgrades)

Management overhead allocation

Regulatory compliance costs

Quality control expenses

Outsourcing service fees (base fees, transaction fees, one-time costs)

Transition and implementation costs

Contract management costs

Potential penalty or incentive payments

Financial Impact Analysis:

Cash flow implications

Capital expenditure vs. operating expenditure considerations

Tax implications

Balance sheet impact

Working capital effects

Foreign exchange exposure (for offshore outsourcing)

Financial ratio impacts

Cost variability analysis

Scalability cost curves

Risk-Adjusted Return Calculation:

Expected cost savings probability distribution

Service quality risk quantification

Business disruption risk valuation

Compliance failure risk assessment

Transition failure risk evaluation

Vendor financial stability risk analysis

Reputational risk valuation

Exit cost estimation

Qualitative Considerations:

Strategic Alignment:

Core competency focus enhancement

Management attention reallocation to strategic activities

Market responsiveness improvement

Innovation capability impact

Competitive positioning effects

Organizational agility enhancement

Strategic flexibility preservation

Growth enablement potential

Operational Benefits:

Process standardization opportunities

Best practice implementation

Access to specialized expertise

Technology advancement acceleration

Scalability improvement

Business continuity enhancement

Service quality improvement

Performance management discipline

Organizational Impact:

Employee morale and engagement effects

Organizational culture implications

Knowledge retention considerations

Skills development opportunities

Change management requirements

Communication challenges

Management complexity

Organizational structure impacts

Hybrid Operational Models

Many UAE and GCC businesses find that a hybrid approach to back office operations provides the optimal balance between control and efficiency.

Common Hybrid Approaches:

Function Segmentation:

Strategic vs. transactional separation (e.g., financial planning in-house, transactional accounting outsourced)

Specialized vs. routine division (e.g., complex tax planning in-house, VAT return preparation outsourced)

Core vs. supplementary split (e.g., compensation strategy in-house, benefits administration outsourced)

Sensitive vs. standard information handling (e.g., executive payroll in-house, general staff payroll outsourced)

Process Segmentation:

Front-end vs. back-end division (e.g., customer-facing accounts receivable in-house, collections outsourced)

Approval vs. execution separation (e.g., payment approval in-house, payment processing outsourced)

Exception vs. standard handling (e.g., complex transactions in-house, routine transactions outsourced)

Design vs. execution split (e.g., report design in-house, regular report generation outsourced)

Geographic Segmentation:

Headquarters vs. branch operations (e.g., corporate accounting in-house, branch accounting outsourced)

Home market vs. expansion markets (e.g., UAE operations in-house, other GCC operations outsourced)

Strategic market vs. secondary market division (e.g., Saudi operations in-house, other markets outsourced)

Regulated vs. less regulated market separation (e.g., DIFC operations in-house, mainland operations outsourced)

Implementation Considerations:

Governance Structure:

Integrated governance framework spanning in-house and outsourced components

Clear decision rights and accountability definition

Coordinated planning and budgeting processes

Joint performance management system

Aligned incentive structures

Comprehensive risk management approach

Unified compliance monitoring

Integrated escalation protocols

Process Design:

End-to-end process mapping with clear handoff points

Responsibility matrix development with no gaps or overlaps

Exception handling procedures spanning both models

Knowledge sharing mechanisms between internal and external teams

Continuous improvement framework encompassing all parties

Standard terminology and definitions across operations

Joint process review cadence

Technology Integration:

Single source of truth establishment

Data synchronization mechanisms

Integrated workflow management

Consistent technology standards

Coordinated change management

Unified security framework

Compatible disaster recovery approaches

Aligned technology roadmaps

Innovation and Future Trends

Artificial Intelligence in Back Office Operations

AI technologies are transforming back office operations from labor-intensive, error-prone processes to intelligent, automated systems that enhance accuracy while reducing costs.

Current Applications:

Intelligent Document Processing:

Automated data extraction from invoices, receipts, and contracts

Natural language processing for unstructured document analysis

Classification of documents by type, content, and priority

Validation of extracted data against business rules

Exception handling with human-in-the-loop processes

Continuous learning from processing patterns

Integration with workflow systems for straight-through processing

Financial Operations Automation:

Anomaly detection in financial transactions

Automated account reconciliation

Predictive cash flow forecasting

Intelligent payment matching

Fraud pattern detection

Automated financial reporting generation

Audit sample selection optimization

Tax calculation and optimization

Human Resources Enhancement:

Resume screening and candidate matching

Employee query handling through conversational AI

Onboarding process automation

Employee sentiment analysis

Attrition prediction and prevention

Talent analytics for workforce optimization

Learning recommendation engines

Performance pattern analysis

Compliance and Risk Management:

Regulatory change monitoring and impact assessment

Transaction screening against sanctions and PEP lists

Contract analysis for compliance requirements

Automated regulatory reporting

Risk pattern identification

Control effectiveness testing

Audit finding prediction

Compliance training personalization

Implementation Considerations:

Data Readiness Assessment:

Data quality evaluation

Data standardization requirements

Historical data availability for training

Data governance framework

Privacy and security considerations

Data integration capabilities

Ongoing data maintenance plans

Master data management approach

Solution Evaluation:

Make vs. buy decision methodology

Vendor assessment criteria

Pilot project design

Success metric definition

Scalability evaluation

Integration requirements

Total cost of ownership calculation

Return on investment projection

Change Management:

Workforce impact assessment

Skill gap identification

Upskilling and reskilling programs

Communication strategy development

Adoption incentive design

New role definition

Career progression redesign

Cultural change management

Governance and Ethics:

Algorithmic bias prevention

Decision explainability requirements

Human oversight mechanisms

Ethical use framework

Regular algorithm auditing

Continuous monitoring procedures

Stakeholder engagement process

Regulatory compliance verification

Preparing for Technological Disruption

The pace of technological change continues to accelerate, requiring SMBs to develop systematic approaches to evaluating and adopting emerging technologies.

Strategic Approaches:

Technology Radar Development:

Systematic scanning of emerging technologies

Relevance assessment methodology

Impact estimation framework

Implementation difficulty evaluation

Risk assessment process

Investment prioritization criteria

Adoption timeline planning

Regular review cadence

Innovation Culture Building:

Innovation mindset development

Idea generation processes

Cross-functional collaboration mechanisms

Experimentation frameworks

Failure tolerance establishment

Recognition systems for innovation

Resource allocation for exploration

Success story communication

Strategic Partnering:

Technology ecosystem development

Startup engagement programs

Academic institution collaboration

Industry consortium participation

Co-creation initiatives

Innovation hub engagement

Knowledge sharing networks

Joint venture exploration

Capability Development:

Digital literacy programs

Technical skill building

Innovation methodology training

Change management capability enhancement

Agile project management skill development

Data analysis capability building

Design thinking methodology adoption

Technology evaluation skill development

Emerging Technologies to Monitor:

Blockchain Applications:

Smart contracts for automated compliance

Secure document verification and authentication

Supply chain traceability and verification

Immutable audit trails for regulatory compliance

Digital identity management

Secure multiparty transaction processing

Tokenization of assets and liabilities

Cross-border payment optimization

Advanced Analytics:

Predictive analytics for business forecasting

Prescriptive analytics for decision optimization

Natural language generation for automated reporting

Computer vision for document processing

Speech analytics for customer interaction analysis

Graph analytics for relationship mapping

Geospatial analytics for location-based insights

Simulation modeling for scenario planning

Cloud Evolution:

Serverless computing models

Containerization for application portability

Microservices architectures

Edge computing for latency-sensitive applications

Multi-cloud strategies for risk distribution

Cloud-native security approaches

API-based integration frameworks

Consumption-based pricing models

Automation Expansion:

Robotic Process Automation (RPA) for routine tasks

Low-code/no-code development platforms

Intelligent process automation combining RPA and AI

Cognitive automation for judgment-based tasks

Conversational interfaces for system interaction

Workflow orchestration platforms

Decision automation frameworks

Autonomous agents for complex tasks

Conclusion

Key Takeaways

Building effective back office operations for SMBs in the UAE and GCC requires a multifaceted approach that balances regulatory compliance, operational efficiency, and strategic alignment. Key success factors include:

Regulatory Vigilance: The rapid pace of regulatory change in the region demands continuous monitoring and systematic implementation processes. From VAT to corporate tax, ESR to UBO regulations, staying ahead of compliance requirements is essential for avoiding penalties and business disruptions.

Financial Discipline: Robust financial management with appropriate controls, standardized processes, and comprehensive reporting forms the foundation of sustainable operations. Adopting appropriate accounting standards, implementing effective cash management practices, and establishing clear financial governance are critical success factors.

Human Capital Optimization: Navigating the complex employment landscape of the GCC requires specialized knowledge and systematic processes. From visa management to WPS compliance, Emiratization to end-of-service benefits, human resources operations demand meticulous attention to detail and proactive management.

Technology Enablement: Leveraging appropriate technology solutions can transform back office operations from cost centers to strategic enablers. Selecting and implementing systems that support compliance, enhance efficiency, and provide actionable insights is increasingly essential for competitive advantage.

Strategic Outsourcing: Thoughtful decisions about which functions to perform in-house versus outsource allow SMBs to access specialized expertise while controlling costs and maintaining appropriate oversight. Hybrid operating models often provide the optimal balance between control and efficiency.

Innovation Mindset: Embracing emerging technologies like artificial intelligence, blockchain, and advanced analytics can drive step-change improvements in back office performance. Developing systematic approaches to evaluating and adopting innovations positions SMBs for long-term success.

Building a Resilient Back Office Operation

Resilience in back office operations—the ability to maintain essential functions despite disruptions—has become increasingly important in the dynamic GCC business environment.

Process Documentation and Standardization: Comprehensive documentation of processes, policies, and procedures ensures consistency and facilitates knowledge transfer. Standard operating procedures should cover normal operations, exception handling, and contingency scenarios.

Cross-Training and Knowledge Management: Reducing key person dependencies through systematic cross-training and knowledge sharing minimizes operational risks. Documentation, job rotation, and collaborative tools help distribute institutional knowledge across the organization.

Technology Redundancy: Implementing appropriate backup systems, disaster recovery capabilities, and business continuity technologies ensures critical functions can continue despite technical disruptions. Cloud-based solutions often provide inherent resilience advantages.

Compliance Monitoring Systems: Proactive compliance management through systematic monitoring, regular self-audits, and robust governance helps identify and address issues before they become significant problems.

Scenario Planning: Developing response plans for various disruption scenarios—from regulatory changes to system failures, staff unavailability to market disruptions—enhances organizational readiness and minimizes reaction time.

Adaptable Structures: Creating flexible organizational designs, scalable technology architectures, and modular process frameworks allows for rapid adaptation to changing business conditions and regulatory requirements.

How Timber Can Help with Back Office Operations

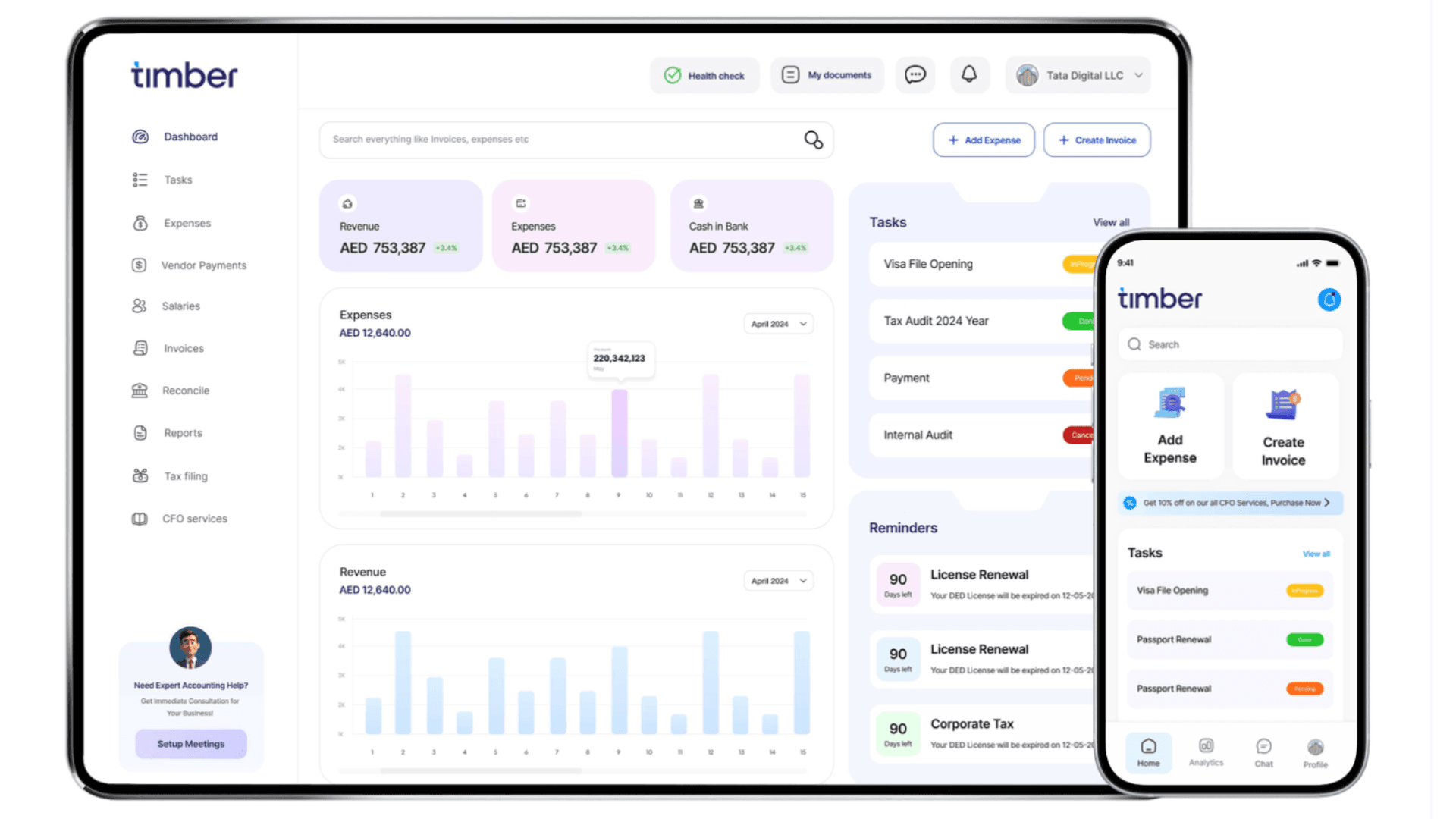

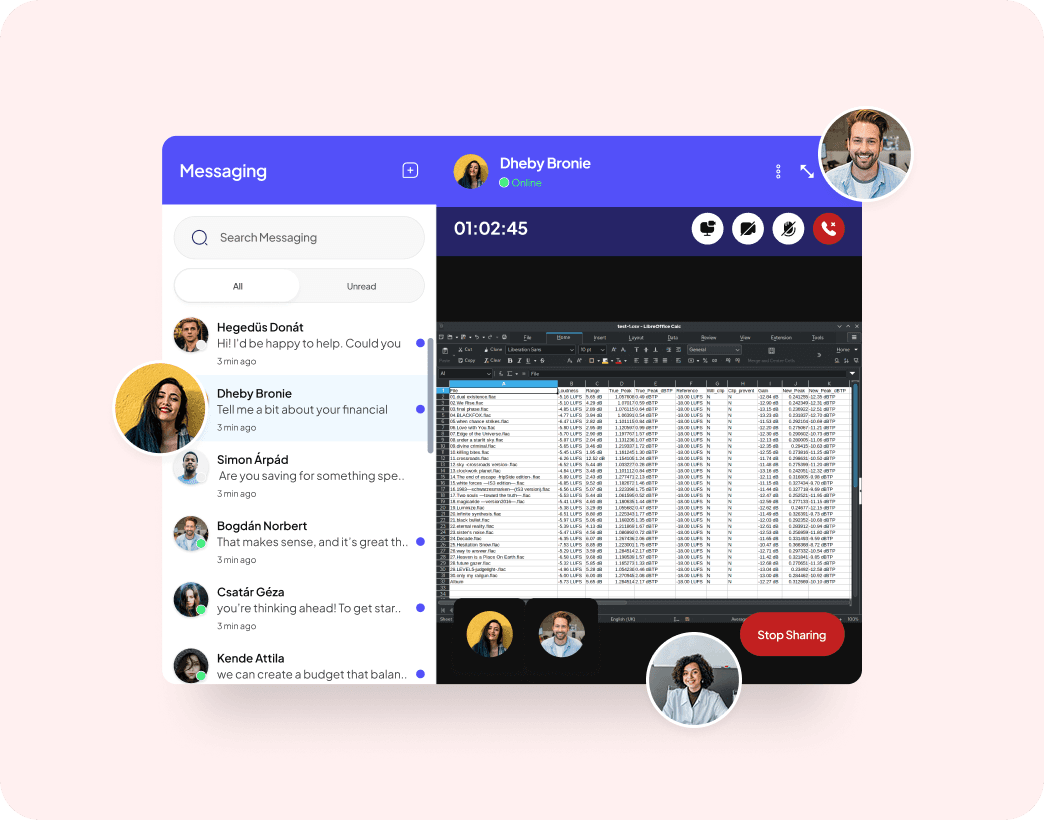

Timber provides comprehensive back office support for SMBs in the UAE and GCC, combining advanced technology with regional expertise to deliver efficient, compliant operations at scale.

AI-Powered Financial Management: Our platform leverages artificial intelligence to automate routine accounting tasks while providing real-time visibility into financial performance. From automated data extraction to intelligent account reconciliation, predictive analytics to anomaly detection, our AI capabilities transform financial operations.

UAE (and other GCC)-Specific Compliance Solutions: Our systems and processes are designed specifically for the UAE and GCC regulatory environment. We maintain continuous monitoring of regulatory changes, implement updates promptly, and ensure your operations remain fully compliant with VAT requirements, ESR regulations, UBO reporting, and the upcoming corporate tax framework.

Integrated Human Resources Management: Our comprehensive HR solutions address the unique challenges of workforce management in the UAE. From visa processing to WPS compliance, Emiratization strategy to end-of-service benefit management, we provide both technology platforms and expert services to optimize your human capital operations.

Flexible Service Models: Recognizing that each business has unique needs, we offer customizable service packages ranging from fully managed outsourcing to targeted support for specific functions. Our hybrid delivery models combine technology platforms, remote services, and on-site support to create the optimal solution for your business.

Technology Advisory and Implementation: Beyond operational services, we provide strategic guidance on technology selection, implementation support, and change management assistance. Our team helps you navigate the complex technology landscape to find solutions that fit your specific requirements and budget.

Scalable Solutions: As your business grows, our services and systems grow with you. From startup to scale-up, our solutions adapt to your changing needs without requiring disruptive transitions or costly system replacements.

With deep regional experience, cutting-edge technology, and a commitment to excellence, Timber helps SMBs build efficient, compliant, and scalable back office operations that support sustainable growth in the dynamic UAE and GCC markets. Contact us today to discover how we can transform your back office into a strategic advantage for your business.

Simplifying accounting and tax filing for businesses

An AI-powered finance solution, supported by real accountants, to simplify your finances without the high costs or complexity of traditional accounting services.