Traditional vs. AI-Powered Accounting & Bookkeeping

AI accounting software is changing the game, making financial management faster, more accurate, and surprisingly more affordable for businesses of all sizes. In this blog, we dive into what is it and how you can leverage AI in accounting - the easy way.

Team Timber

•

Fri 02 May, 2025

The world of accounting and bookkeeping is undergoing a remarkable transformation. What once meant hours of manual data entry, mountains of paperwork, and endless calculations is now becoming streamlined through artificial intelligence. AI accounting software is changing the game, making financial management faster, more accurate, and surprisingly more affordable for businesses of all sizes.

From small startups to established enterprises, companies are discovering how AI-powered tools can turn tedious bookkeeping tasks into automated processes that happen in the background. This evolution isn't just about saving time – it's about gaining deeper insights into your business finances and making smarter decisions based on real-time data.

Traditional Accounting and AI-Powered Accounting

The contrast between traditional and AI-powered accounting couldn't be more stark. Where traditional methods rely on manual processes and human effort, AI brings automation and intelligent analysis. But this isn't about completely abandoning proven accounting principles – it's about enhancing them with technology that makes financial management more efficient, accurate, and insightful.

As we examine the specific differences between these approaches, you'll see how AI doesn't replace the fundamental principles of accounting but rather transforms how we apply them. The following comparative analysis will help you understand exactly what changes when you move from traditional to AI-powered accounting, and why businesses worldwide are making this transition.

What does traditional accounting and bookkeeping involve?

Traditional accounting has been the backbone of business finance for centuries. At its core, it relies on:

Core principles and methodologies: The fundamental principles of double-entry bookkeeping, where every transaction affects at least two accounts. These time-tested methods ensure accuracy but require significant manual oversight.

Manual processes and documentation systems: From recording transactions in ledgers to filing receipts in filing cabinets, traditional accounting involves hands-on work. Each invoice, payment, and expense needs to be manually entered and categorized.

Role of human expertise and professional judgment: Accountants bring years of training and experience to interpret financial data, spot inconsistencies, and make judgment calls on complex transactions.

Established compliance frameworks and standards: Traditional accounting follows strict guidelines like GAAP (Generally Accepted Accounting Principles) and requires regular audits to ensure compliance.

Traditional software tools and their limitations: While tools like Excel and basic accounting software have helped, they still require significant manual input and are prone to human error.

What is AI-based accounting and bookkeeping?

AI accounting software represents a quantum leap forward in financial management:

Evolution from basic automation to intelligent systems: Modern AI goes beyond simple automation, using machine learning to understand patterns and make intelligent decisions about financial data.

Integration possibilities with existing financial ecosystems: AI systems can connect with banks, payment processors, and other financial tools to create a seamless flow of information.

Automated data capture and entry capabilities: Imagine taking a photo of a receipt, and having the AI automatically extract all relevant information and categorize the expense correctly.

Real-time financial reporting and analytics: Instead of waiting for month-end reports, businesses can see their financial status updated in real-time.

Pattern recognition for anomaly detection: AI can spot unusual transactions or potential fraud much faster than human review.

Predictive analysis for cash flow management: By analyzing historical data, AI can forecast future cash flow needs and highlight potential shortfalls.

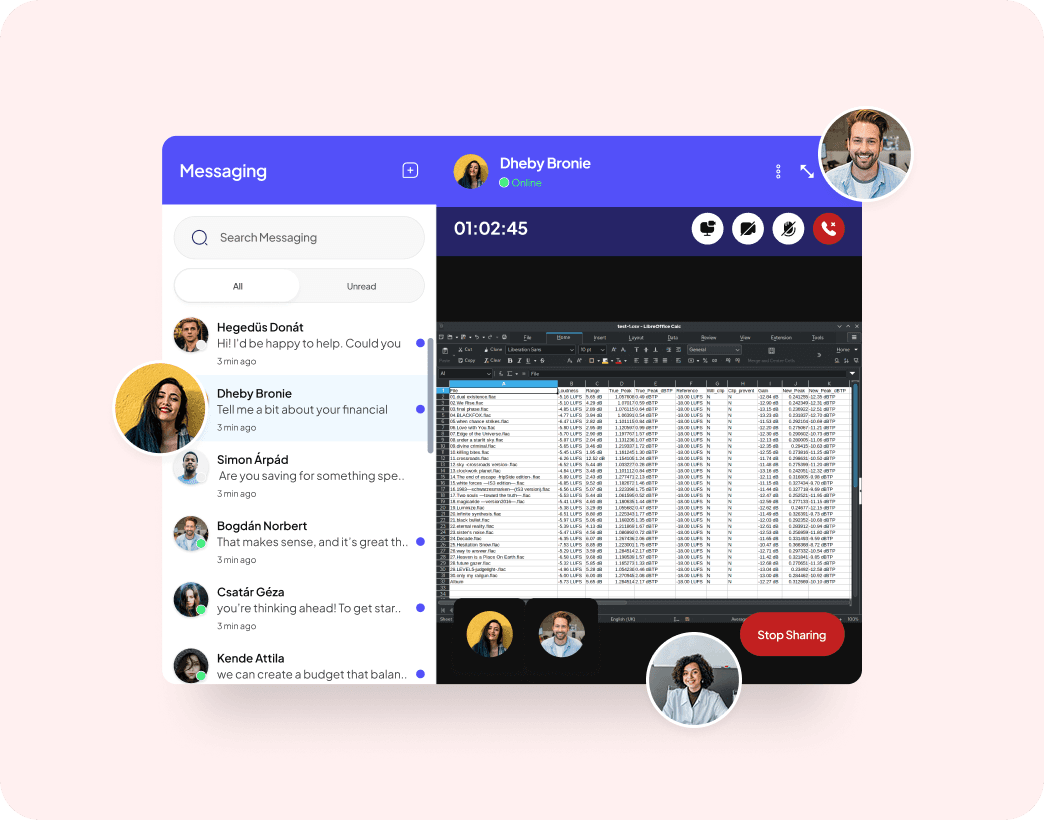

Cloud-based accessibility and collaboration: Access your financial data from anywhere, with team members able to collaborate in real-time.

Traditional vs. AI-Powered Accounting & Bookkeeping: Comparative Analysis

Aspect | Traditional Accounting | AI-Powered Accounting |

Core Functions | ||

Data Entry | Manual input of every transaction | Automated capture from invoices, receipts, bank feeds |

Transaction Categorization | Human review and categorization | AI-powered automatic categorization with learning capabilities |

Reconciliation | Manual matching of transactions | Automated reconciliation with smart matching algorithms |

Financial Reporting | Period-end manual report generation | Real-time dashboards and instant report generation |

Tax Preparation | Manual calculation and form filling | Automated tax calculations and form preparation |

Cost-Efficiency | ||

Initial Investment | Lower upfront costs | Higher initial software investment |

Long-term ROI | Higher ongoing labor costs | Significant cost savings over time |

Staff Requirements | Multiple bookkeepers/accountants needed | Reduced staff requirements |

Error Costs | Higher due to manual errors | Minimal errors, reduced correction costs |

Efficiency Metrics | ||

Processing Time | Hours per day for data entry | Minutes for automated processing |

Error Rate | 1-5% human error rate | Less than 0.1% error rate |

Scalability | Limited by human capacity | Easily scales with business growth |

Report Generation | Days to prepare | Instant access to reports |

Security | ||

Data Protection | Physical document security risks | Advanced encryption and cloud security |

Fraud Detection | Manual review, often after the fact | Real-time anomaly detection |

Backup Systems | Manual backup procedures | Automatic cloud backups |

Compliance | Manual compliance checks | Automated compliance monitoring |

The Human-AI Collaboration in Modern Accounting

The rise of AI doesn't mean the end of accounting professionals – it means their roles are evolving. Instead of spending time on data entry, accountants can focus on:

Strategic financial planning and analysis

Complex problem-solving and advisory services

Building client relationships

Interpreting AI-generated insights for business decisions

This collaboration creates a powerful synergy where AI handles the repetitive tasks while humans provide the strategic thinking and personal touch that businesses need.

Most accounting tools today are implementing this approach. Timber, for instance, has an on-demand accountant feature that lets you combine powerful AI with expert human accountants who understand your business needs.

AI-Powered Accounting Implementation Strategies for Businesses

Moving from traditional to AI-powered accounting doesn't have to be overwhelming. Here's a practical approach:

1. Assessing Organizational Readiness

Before diving into AI accounting, businesses need to evaluate their current state. This means examining your existing processes, technology infrastructure, and staff capabilities. Consider your data organization – are your financial records digitized? How complex are your accounting needs? Understanding where you stand helps create a realistic implementation timeline.

2. The Hybrid Approach: Best of Both Worlds

Smart businesses often adopt a hybrid model during transition. This means maintaining some traditional processes while gradually introducing AI elements. For example, you might start by automating invoice processing while keeping manual review for complex transactions. This approach reduces risk and helps staff adapt gradually.

3. Change Management and Staff Training

Your team is crucial to successful implementation. Create a comprehensive training program that addresses:

Basic AI concepts and how they apply to accounting

Hands-on workshops with the new software

Regular check-ins to address concerns and questions

Advanced training for power users who can become internal champions

4. Cost-Benefit Analysis Framework

Before implementation, conduct a thorough financial analysis:

Calculate current costs: staff time, error correction, software licenses

Estimate implementation costs: new software, training, transition time

Project future savings: reduced labor hours, fewer errors, faster processing

Consider intangible benefits: improved decision-making, better compliance

Swicth to Timber's AI Accounting Solution

The shift toward AI-powered accounting isn't just a trend – it's the future of financial management. Businesses clinging to traditional methods risk falling behind competitors who leverage AI for faster, more accurate, and more insightful financial operations.

As AI continues to evolve, the gap between traditional and AI-powered accounting will only widen. The time to start your transformation is now. Whether you're a small business looking for free AI accounting software or an enterprise seeking comprehensive solutions, the benefits of AI accounting are clear:

Dramatic time savings

Reduced errors

Real-time insights

Lower long-term costs

Better financial decisions

For businesses in the GCC region, Timber offers a revolutionary approach to accounting that addresses the unique challenges of the market. With new tax regulations making accounting mandatory and traditional services being prohibitively expensive, Timber provides an innovative solution.

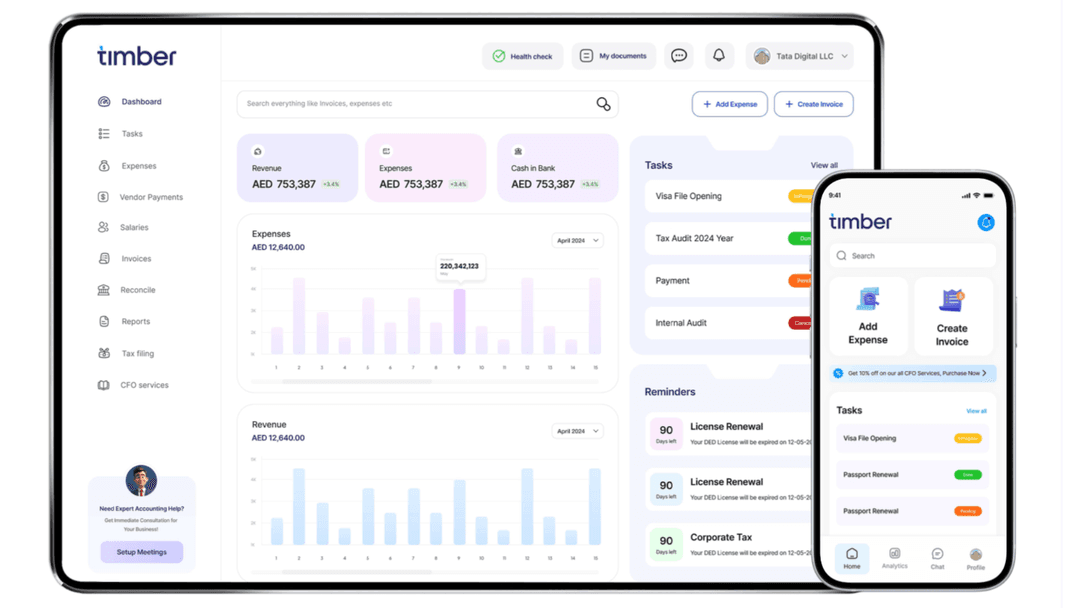

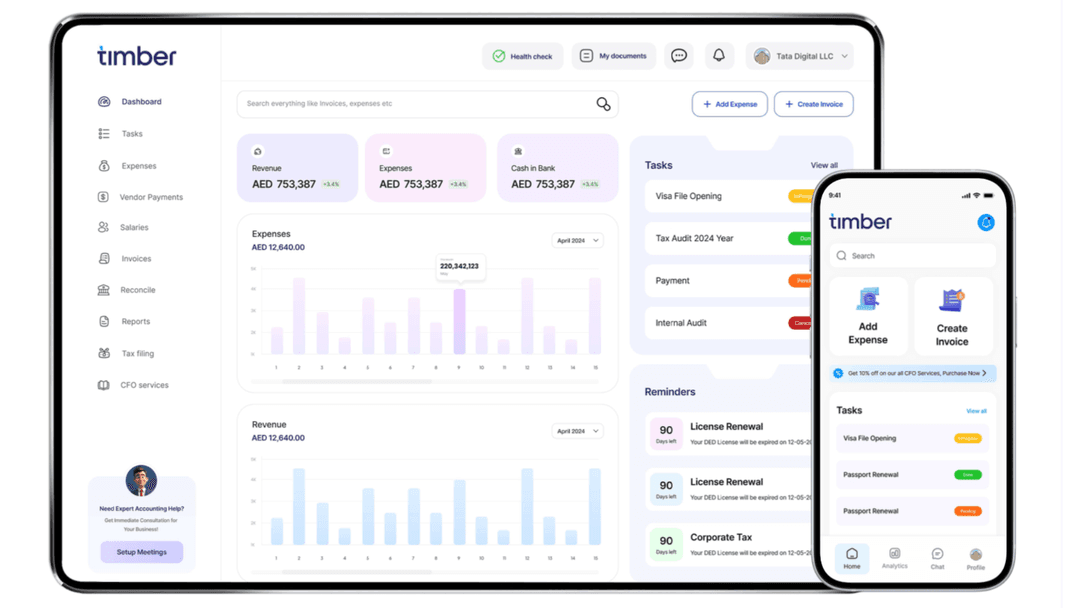

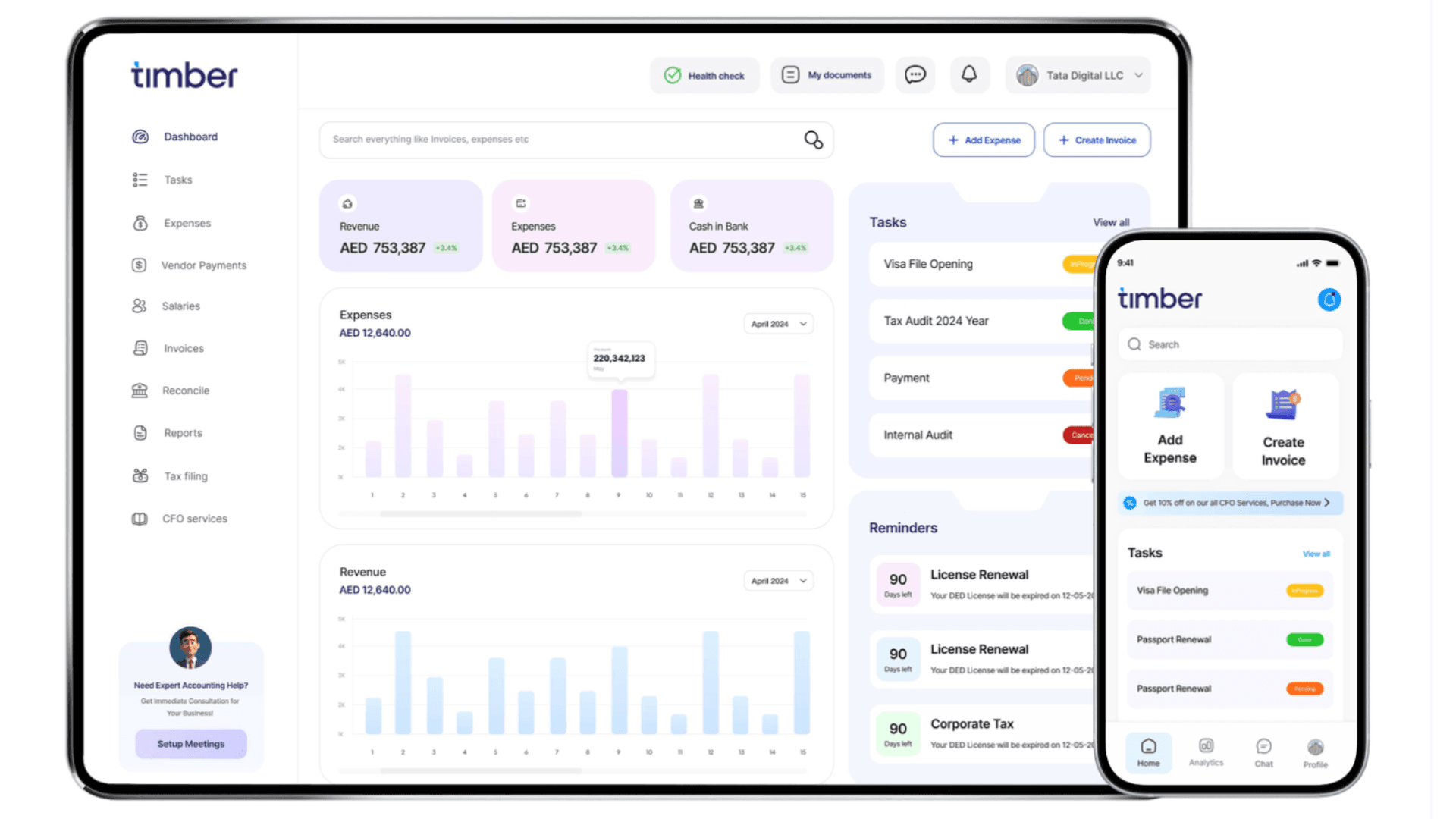

How Timber Works

Timber acts as an intelligent layer between your business and professional accountants, powered by AI technology. Small businesses can upload their documents and expenses in real-time, while a network of remote accountants manages their books efficiently and affordably.

Key Timber Features:

Real-time document upload:

Snap a photo of receipts or invoices, and they're instantly processed

AI-powered dashboards:

See your financial health at a glance with metrics like cash flow, pending invoices, and growth trends

Smart accountant matching:

Connect with pre-vetted accountants who understand your industry

Seamless integration:

Works with popular accounting software like Zoho, Wafeq, Xero, and QuickBooks

Affordable pricing:

Access professional accounting at a fraction of traditional costs

Unlike traditional outsourced bookkeeping that hasn't evolved in decades, Timber brings modern technology to financial management. Businesses gain real-time visibility into their finances, understand key metrics like customer acquisition costs, and receive professional guidance – all through one platform.

Simplifying accounting and tax filing for businesses

An AI-powered finance solution, supported by real accountants, to simplify your finances without the high costs or complexity of traditional accounting services.